If you’re a financial advisor still dealing with stacks of paperwork, you already know how frustrating it can be. Chasing clients for signatures, managing physical files, and ensuring compliance with endless regulations—it’s time-consuming, tedious, and, honestly, outdated for the time (digital-era) we are in.

That’s why so many financial advisors are switching to e-signatures. Not only do they streamline workflows, but they also keep you compliant with industry regulations while saving time, reducing costs, and improving client satisfaction.

So, what’s behind this shift? And why should you make the move if you haven’t already?

Compliance Made Simple.

Staying compliant is non-negotiable in the financial world. Every form, contract, and agreement needs to be signed, stored, and managed correctly to meet regulatory requirements. But doing this manually is a headache—and a risky one at that.

Meeting Industry Regulations.

E-signatures from https://www.sign.plus/ are legally recognized under laws like the ESIGN Act and UETA, ensuring that digital signatures hold the same weight as traditional ones. This means that whether you’re working with the SEC, FINRA, or other regulatory bodies, e-signatures help you stay within compliance without the hassle of physical paperwork.

Audit-Ready at All Times.

Forget digging through filing cabinets. E-signature platforms automatically track and timestamp every step of the signing process, providing a clear, verifiable audit trail. If regulators ever need proof, you have everything neatly organized and ready to go.

Secure & Tamper-Proof.

Paper documents can be lost, forged, or damaged. E-signature platforms use encryption, multi-factor authentication, and digital certificates to ensure that every signature is authentic and secure. That’s peace of mind for both you and your clients.

Efficiency That Saves You Hours.

Time is money, and financial advisors can’t afford to waste it on unnecessary admin work. E-signatures eliminate the slow, manual processes that drain productivity.

No More Printing, Scanning, or Mailing.

With e-signatures, you can send, sign, and receive documents in minutes—no printing, scanning, or mailing required. Clients can sign from their phones, tablets, or computers, cutting turnaround times from days to hours (or even minutes).

Faster Client Onboarding.

New clients often mean stacks of paperwork, from account agreements to disclosures. Instead of waiting for physical signatures, e-signatures allow clients to complete forms instantly, so you can onboard them quickly and start helping them sooner.

Automated Workflows.

Most e-signature platforms integrate with CRM systems, document management tools, and even compliance software. This means you can set up automated workflows, reminders, and approvals—keeping everything moving without manual follow-ups.

Cost Savings That Add Up.

Paper-based processes come with hidden costs—printing, postage, storage, and even lost time chasing signatures. Moving to e-signatures eliminates these expenses, making your business more cost-efficient.

No More Printing & Mailing Costs.

Think about how much you spend on paper, ink, envelopes, and postage every year. E-signatures make all of that unnecessary, helping you cut down on office expenses.

Fewer Errors & Redos.

Paperwork mistakes can be costly. Missing signatures, incorrect forms, or incomplete fields mean delays and extra work. E-signature platforms reduce errors by ensuring that all required fields are completed before submission.

Less Office Space Needed.

Storing physical documents takes up valuable space—and if you’re paying for off-site storage, that’s an added cost. Digital document management means you can store everything securely in the cloud, reducing clutter and storage expenses.

A Better Experience for Clients.

Clients expect convenience, and outdated paper-based processes don’t offer that. E-signatures provide a seamless, modern experience that improves client relationships.

Sign Anytime, Anywhere.

Whether your clients are across town or across the country, they can sign documents from anywhere—no need to visit your office or deal with the hassle of mailing paperwork.

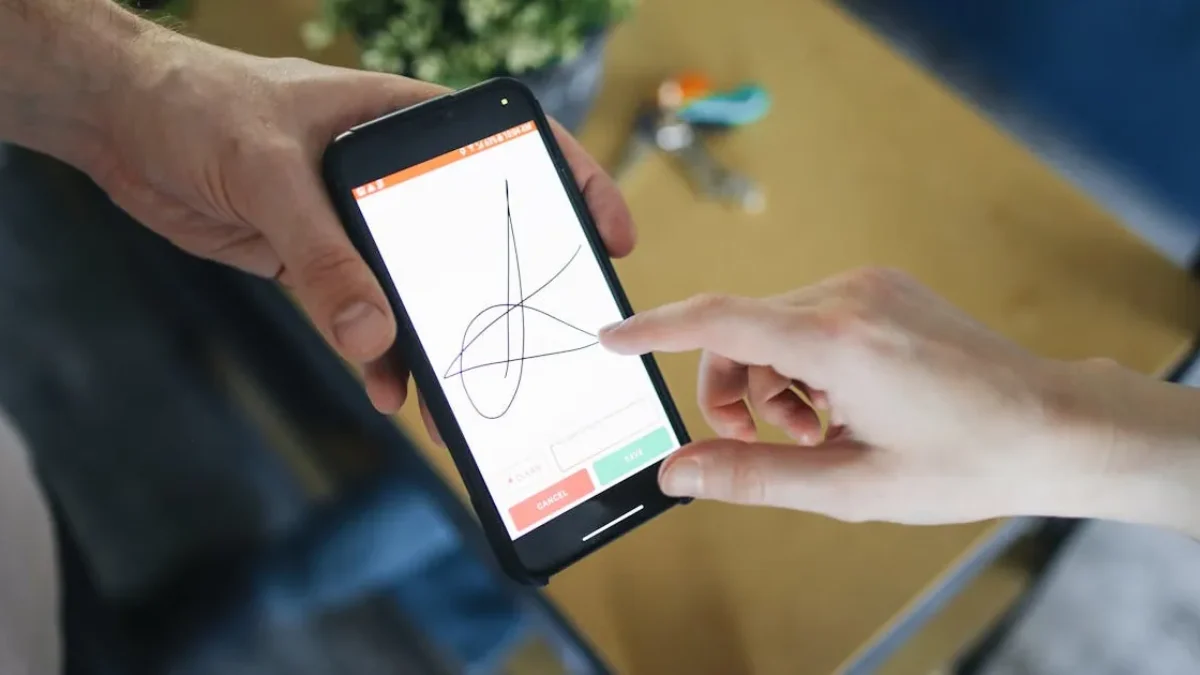

Mobile-Friendly for Busy Clients.

Many high-net-worth clients are constantly on the go.

E-signature solutions work on mobile devices, allowing clients to sign forms with just a few taps, making the process quick and effortless.

Professional & Modern Image.

Using e-signatures signals that your firm is tech-savvy and forward-thinking.

Clients expect modern solutions, and providing a seamless digital experience builds trust and credibility. You build a better reputation of business when things get done swiftly.

Choosing the Right E-Signature Platform.

Not all e-signature tools are created equal, so it’s important to choose one that meets the needs of financial advisors.

- Compliance Features – Ensure the platform is compliant with SEC, FINRA, and ESIGN Act regulations.

- Integration Capabilities – Look for tools that sync with your CRM, document management system, and financial planning software.

- Security Measures – Choose a platform with encryption, authentication, and audit trails for maximum security.

- Ease of Use – The tool should be intuitive for both you and your clients. A complicated system defeats the purpose.

- Scalability – Whether you’re a solo advisor or part of a large firm, the platform should scale with your business.

The Shift is Happening—Don’t Get Left Behind.

Financial advisors are moving to e-signatures because they make compliance easier, boost efficiency, save money, and create a better client experience. The traditional way of handling paperwork is outdated, slow, and costly. Switching to e-signatures isn’t just a convenience—it’s a necessity to stay competitive in today’s digital world.

If you’re still relying on paper, now is the time to make the shift.

Leave a Reply