In the dynamic realm of business, keeping an organization on track is more than just an ambition; it’s essential. Central to this operational excellence is a robust internal control system. Statistics indicate that companies lose about 5% of their annual revenue to fraud. Quite a shocking statistic, right?

But here’s the good news: an effective internal control system is able to significantly mitigate these risks, safeguarding an organization’s assets and reputation. Beyond fraud prevention, there are a myriad of other benefits to having a robust internal control framework in place. In this post, we’ll delve into five compelling advantages that every business leader should be aware of.

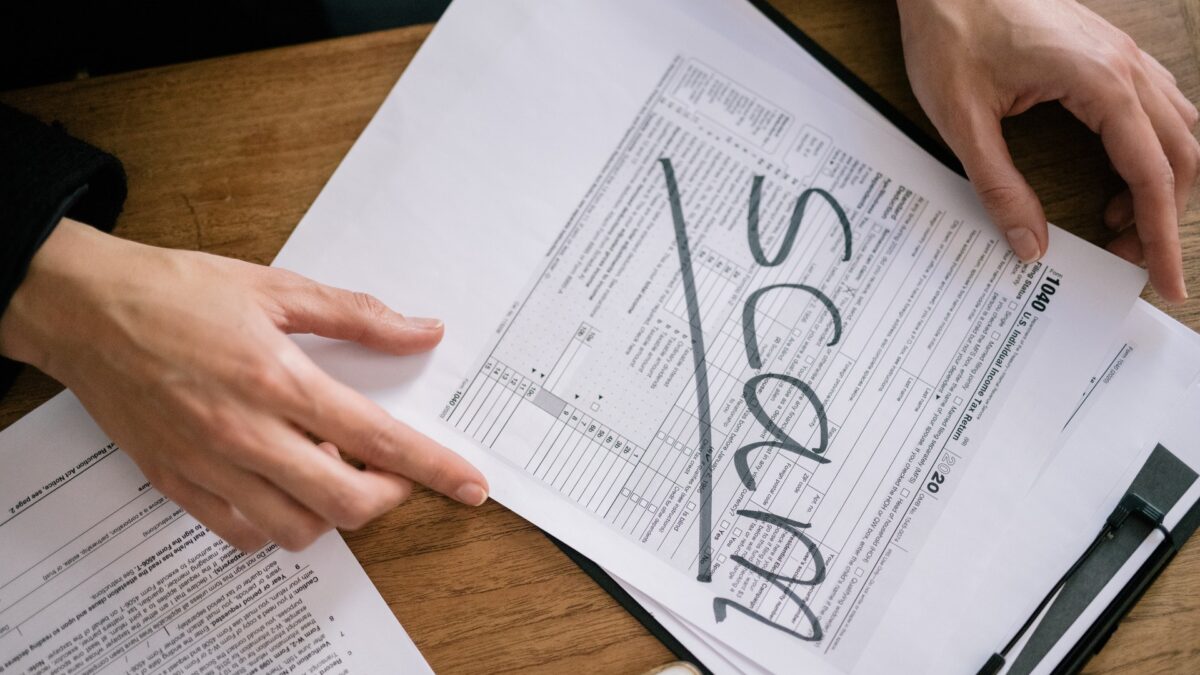

Risk mitigation and fraud prevention.

An effective internal control system provides businesses with a layer of protection against potential risks and fraud. Beyond external threats, internal vulnerabilities can disrupt operations just as severely. Through systematic identification and assessment of these risks, businesses can preemptively address them.

For example, comprehensive controls like information technology general controls (ITGC) can uncover potential gaps in procurement processes, thwarting unauthorized transactions. The scope of ITGC controls includes elements like access controls, system development, and data integrity checks, fortifying the organization’s digital landscape.

Additionally, internal controls play a pivotal role in preventing fraud. Consider the headlines generated by immense corporate fraud cases. By implementing robust controls, these incidents could have been averted or detected early, safeguarding organizations from financial turmoil and reputational harm. Establishing checks and balances, such as segregation of duties within IT systems and regular audits, creates an environment less conducive to fraudulent activities.

Improved operational efficiency.

Imagine an orchestra without its maestro, resulting in a jumble of noises instead of melodious tunes. In the same vein, lacking internal controls in business can spawn disorder and inefficiency.

A well-designed internal control system serves as the conductor, organizing processes to ensure smooth operations and consistent execution. By providing clear guidelines and procedures, organizations are able to minimize errors and rework, thereby boosting overall efficiency.

Consider a manufacturing company that implements a rigorous internal control system on its production line. Every stage of the production cycle, from sourcing raw materials to quality assurance, is diligently recorded and observed. This not only minimizes production mishaps but also ensures that the final product aligns with top-tier quality benchmarks, amplifying customer contentment and allegiance.

Accurate financial reporting.

Precise financial data stands as the cornerstone of any organization’s decision-making framework. The role of an internal control system is crucial in safeguarding the precision and dependability of financial records. Inaccurate financial data can lead to misguided business decisions, investor distrust, and regulatory penalties. With a robust internal control system in place, financial data undergoes rigorous scrutiny, reducing the likelihood of misstatements and errors.

Take, for example, a publicly traded company preparing its quarterly financial statements. An effective internal control system ensures that transactions are accurately recorded, assets are properly valued, and liabilities are correctly accounted for. This transparency reassures shareholders and investors, promoting trust and maintaining the company’s market reputation.

Compliance and legal adherence.

In today’s complex regulatory landscape, adherence to laws and industry standards is non-negotiable. An internal control system acts as a compass, guiding organizations through the intricate maze of compliance requirements. From data security to privacy regulations, these controls safeguard sensitive information and ensure legal compliance.

The healthcare industry is a prime example of where patient data privacy is of paramount importance. Implementing internal controls ensures that patient records are accessed only by authorized personnel and that data breaches are swiftly detected and addressed. This not only prevents legal liabilities but also upholds the ethical responsibility of protecting patient confidentiality.

Enhanced accountability and transparency.

In an organization, accountability is not just a buzzword; it’s a cornerstone of effective management. An internal control system establishes clear responsibilities and assigns ownership for various tasks and processes. This accountability fosters a culture of diligence and ownership among employees, promoting a sense of ownership and pride in their roles.

Transparency, often mentioned in corporate values, is actualized through documented processes and comprehensive audit trails. An effective internal control system ensures that actions are traceable and accountable, making it easier to investigate any irregularities that may arise. This level of transparency enhances stakeholder trust, be it among shareholders, investors, or customers, who can confidently engage with an organization that conducts its affairs with integrity.

Final thoughts.

Incorporating a strong internal control system isn’t just an option; it’s a strategic imperative. From fortifying security to bolstering transparency, its benefits ripple across an organization. Whether you’re a startup or an industry giant, harnessing these advantages ensures a resilient framework for growth and trust-building. As you navigate the complex business terrain, remember that a well-structured internal control system is your steadfast companion on the journey to success.

Leave a Reply