You can accomplish any task even personal finance with the right equipment and know-hows.

Computer applications excel in simplifying the most complex tasks. Why not use one of many financing apps to help you pay off your debts? First, you have to consider what kind of debts that need your fiscal attention. Whether they’re housing, automotive, educational, or medical, each is bound to have their own set of hidden interest fees. You’ll also need to calculate Annual Percentage Rates and factor in additional expenses.

Listed below are some key areas that financing software can help you through. You’ll be amazed at how many processes one or two programs can benefit your wallet.

Credit score reporting feature.

Typing “free credit report” into a search engine box will bring millions of results. The highest on the results page will promise free service, but may not be 100% honest or free.

Credit Karma is a reliable source for accurate, free credit reporting. When you sign up for their exclusive app, all you give them is your name and contact information. No credit card numbers needed! All of Credit Karma’s data is sourced from nationally renowned credit reporting agencies. Get real-time updates on identity security and changes to your score right from your smartphone.

Calculation of various debts.

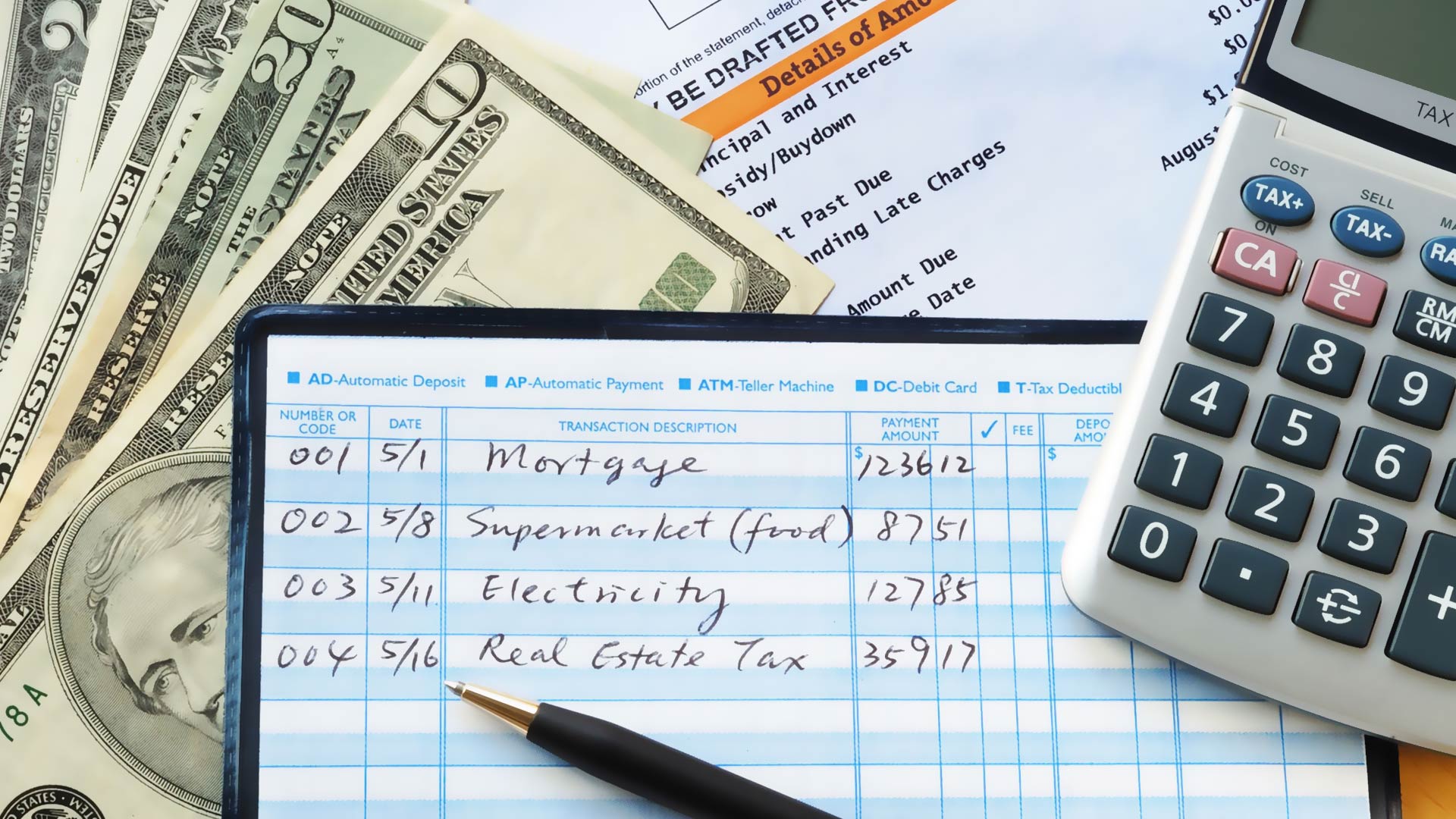

Sometimes we all need a simple calculator. Calculators are as cheap and plentiful as pencils, but most can’t process the intricacies behind your various debts.

Unbury.me is a simple, no-frills program that lets you total your loan debts. Start by filling in the loan type, the remaining principal, interest percentage, and the monthly minimum payment. Once those have been entered you can compare the results to two types of debt reduction-“Avalanche” and “Snowball.” After that, it’s up to you to decide which method is the right one.

Strategy development.

The previously mentioned programs offer plenty of help when it comes to numbers, but little in the way of planning. Debt Analyzer goes beyond numbers processing to aid in you in generating realistic payment plans. Prioritize debts based on interest rates, balances, and loan terms. Create calendars that schedule payments on your Charlotte home, automobiles, credit cards, and other debts and loans. Use this data to develop monthly “progress reports” on your debts’ payoff.

You can even generate “what if” projections for consolidations, reductions, and accelerated payment. Budget your households with entries on variable payments and apply budget surpluses to your debt’s repayment plan.

Security features for your sensitive information.

A common concern about managing debt from online resources and software is security. Even though most of the applications mentioned do not require sensitive account information, you would still be sharing personal figures over the web.

Apps associated with personal finance can access your information on a restricted basis. The information they receive is rendered as “Read Only,” and cannot be altered by the service. Services that offer automatic bill payment do not feature this safe guard.

Before signing up, look for verifications from TRUSTe, VeriSign, and MacAfee. Maximize security by having an app that runs offline through a secure password.

Leave a Reply