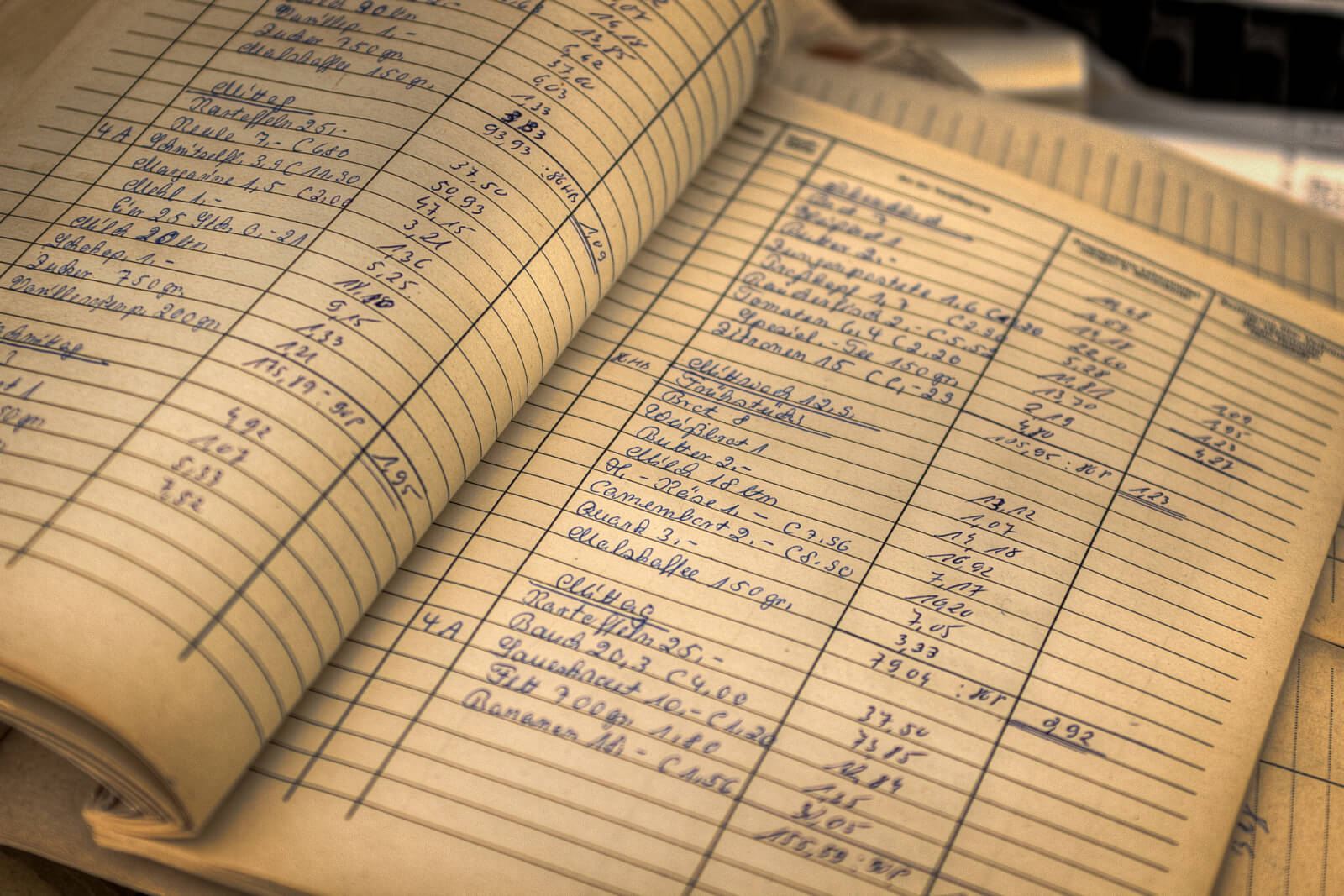

The Double Entry Bookkeeping system is scientific, perfect, and a complete method of recording business information in the books of accounts.

Generally, in every business transaction, we find two accounts, out of which one account is given debit effect and another account is given credit effect.

In other words, in this system for every debit, there is a corresponding credit and all debits are equal to all credits. If anything comes into the business, an account of that item is to be debited and if anything goes out from business, an account of that item is to be credited in the books of account.

Take an example here…

Assume, Patrik bought goods from Michael worth Rs. 5,000 by paying cash. Here, Patrik gets goods of Rs. 5,000 and parts with cash of Rs. 5,000.

In the books of Patrik, Goods A/c. will be given debit effect to extent of Rs. 5.000 and Cash A/c. will be given credit effect to extent of Rs. 5,000.

Thus, every business transaction is split up into two parts or two aspects, i.e. debit aspect and credit aspect.

The debit effect is posted to the debit side of Ledger A/c. and the credit effect is recorded on the credit side of the Ledger A/c. It means every business-related transactions are recorded in two different accounts at two different locations.

In this manner, in the double-entry bookkeeping system, completed business transactions are recorded in journals as well as in ledgers.

At the end of the accounting year, all ledger accounts are closed and balanced. The balance shown by each ledger account is then recorded on a separate sheet in order of debit and credit. This is known as trial balance. When this process is over, the debit column and credit column of the trial balance are totaled. The debit side total agrees or equals with the credit side total. It means every debit is given equivalent credit under the double-entry bookkeeping system.

This is the correct and scientific method of recording business transactions in the books of accounts. This double-entry bookkeeping system of accounting is almost universally applied in every organization.

Thus, the double-entry bookkeeping system seeks to record every business transaction in money or money’s worth in its double aspects viz. debit and credit.

Advantages of Double-Entry Book Keeping System

- By recording double aspects of each transaction in the books of accounts, it ensures an arithmetical accuracy of the account.

- This system is helpful to detect, prevent, and reduce fraud.

- If at all any mistake occurs, it can be detected and rectified.

- The exact amount due to us from customers/debtors and other parties, and the exact amount payable to creditors/suppliers by us can be known easily from the records maintained as per this system.

- This accounting system keeps complete, accurate, and perfect records of business transactions.

- This accounting system is suitable for all types of business organizations i.e. small scale, medium scale, and large scale, public and private business organization, etc.

- This accounting system is helpful to prepare trial balances and final accounts of the business at the end of the accounting year.

- With the help of this system income statements of the current year can be compared with the income statements of previous years and on the basis of that comparison, a business gets information about the variations in income and expenses. To control expenses, a businessman can adopt different measures.

Disadvantages of Double-Entry Book Keeping System

- If the amount of a transaction is wrongly recorded in the Journal, it is difficult to find out this mistake.

- It is very difficult to locate any business transaction which is not recorded in the main books of account.

- Posting under wrong account heads but on the right side, such errors may not be detected by this system.

- Compensating errors and errors of omission can not be detected by this accounting system.

- This system is more lengthy, elaborate, and complex in nature.

Leave a Reply