In the world of economic predictions, the Benner Cycle has an interesting and almost mystique status among those who study market trends.

This theory, developed in the 19th century, suggests that economic cycles follow a predictable pattern, hinting that we can forecast future booms and busts.

But how accurate is the Benner Cycle in our modern world? Is it relevant anymore? Can it really be trusted as a reliable tool today? Or just an outdated theory!

Let’s learn what the Benner Cycle is, how it has fared over time, and whether it holds any relevance in today’s digital fast-paced global economy.

What is the Benner Cycle?

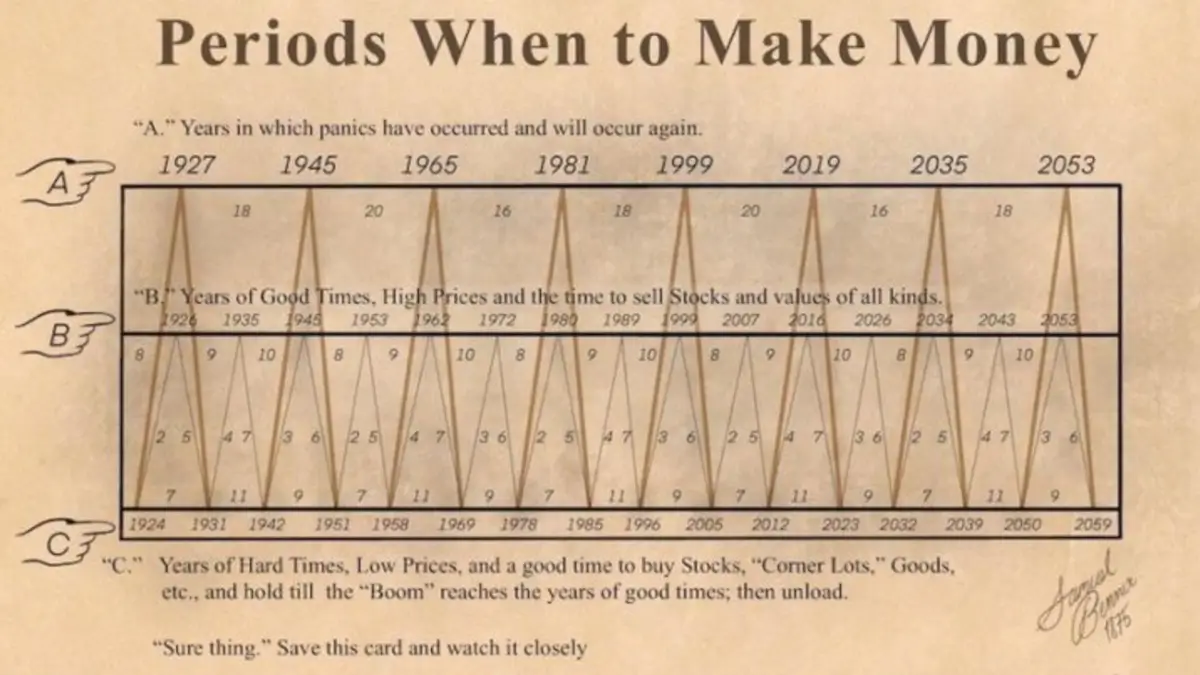

The Benner Cycle was developed by Samuel Benner, a 19th-century farmer who analyzed historical economic data to try and predict future market behavior.

His theory, first published in 1875, was based on the observation of periodic peaks and troughs in the economy, which he attributed to cyclical forces. Benner believed these cycles could help predict when to expect economic booms and recessions.

Benner’s theory proposed that economies follow an 11-year cycle for downturns, an 8-year cycle for moderate dips, and a 27-year cycle for major economic growth.

He mapped out these cycles, aiming to help others understand when to invest, save, or prepare for leaner times. Surprisingly, Benner’s predictions were close enough to actual economic outcomes that his cycle theory has remained a topic of curiosity among economists and market watchers for over a century.

How Accurate is the Benner Cycle?

For a theory from the 1800s, the Benner Cycle has shown a remarkable degree of accuracy, particularly in capturing general trends.

Many believe that the cycle has accurately predicted significant economic downturns, including the Great Depression in the 1930s, the stagflation of the 1970s, and even the 2008 financial crisis.

However, the accuracy of the Benner Cycle is far from perfect.

The theory can give us clues about the rhythm of economic highs and lows, but it doesn’t provide specific details about the scale, causes, or timing of these fluctuations. And with modern economies being far more complex than in Benner’s day, some question whether his historical analysis still applies.

Moreover, global economics have evolved dramatically since the 19th century. The modern economy is shaped by globalized trade, rapid technological advancement, and unprecedented levels of government intervention—all of which complicate or even distort traditional economic cycles. For this reason, many economists argue that while Benner’s Cycle can provide some perspective, it’s not a silver bullet.

Can the Benner Cycle Be Trusted Today?

While Benner’s Cycle offers intriguing insights, it’s important to approach it with caution. Here are some pros and cons of using it today:

Pros:

- Historical Accuracy: The Benner Cycle has correctly anticipated several major economic trends, proving that there’s some merit in long-term cycle analysis.

- Psychological Impact: Believing in an economic cycle can encourage people to act cautiously, particularly if a downturn seems imminent. This can help people prepare for the worst.

- Broad Perspective: The Benner Cycle doesn’t focus on short-term market moves, which can reduce anxiety for long-term investors who seek a big-picture view.

Cons:

- No Guarantees: The Benner Cycle lacks precision and can be misleading if relied on solely. It’s a generalized approach that may miss critical details or misinterpret trends.

- Modern Complexities: Today’s globalized economy and rapid technological advancements create unprecedented factors that Benner’s 19th-century model simply couldn’t account for.

- Market Anomalies: The theory assumes a predictable rhythm, but economic shifts can be random, influenced by black swan events, or human-driven through policy shifts and innovations.

For investors, the Benner Cycle can serve as one tool among many but shouldn’t be the sole foundation of a financial strategy.

Is the Benner Cycle Relevant Today?

The Benner Cycle has the allure of an age-old wisdom that might still carry some truth. And while it’s a compelling framework, the reality is that no economic model has all the answers—especially one developed nearly 150 years ago.

However, understanding cycles and patterns in history can remind us that the economy naturally fluctuates. For those who believe that history often repeats itself, the Benner Cycle might still have some relevance.

Whether you trust it or not, the Benner Cycle is a fascinating example of historical economic analysis. If used thoughtfully—perhaps in combination with more modern economic models—it might still provide value. Just remember: no predictive model can replace thorough research, diversification, and careful financial planning.

Final Thoughts.

The Benner Cycle is a thought-provoking framework with some historical success, but it’s far from a foolproof tool for today’s complex economy. Those interested in cyclical analysis might find value in it, but it’s essential to balance it with insights from modern data, expert opinions, and, of course, a healthy dose of skepticism.

What are your thoughts? Have you encountered the Benner Cycle before, or do you believe in economic cycles more generally?

Let’s continue the conversation in the comments!

Leave a Reply